Pension lump sum tax calculator

Estimate Your Annual Monthly Benefit Today. There are different regulations around how your pension provider will initially apply tax on your pension lump sum dependent on the size of your pension savings and whether you have.

1

Most DB plans offer the option of a one-time lump sum payment or monthly benefit payouts.

. Calculate average annual pay for last three years. Calculate 115 of the average. In the context of pensions the former is sometimes.

The pension before commutation is 20000 a year. Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2020-21 2021-22 and 2022-23 tax years. From Life Retirement Planning To Investing Our Free Calculators Are Here To Help.

Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Discover Helpful Information And Resources On Taxes From AARP. Tax relief on retirement lump sum benefits is allocated once in a lifetime in other words if its used up you cant claim it again.

We have the SARS tax rates tables. How to Avoid Taxes on a Lump Sum Pension Payout. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Currently a maximum of 200000 can be taken as a tax free pension lump sum. How to Calculate Taxes on a Lump Sum Sapling.

Find out what the required annual rate of return required would be for. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. This calculator will help you figure out how much income tax youll pay on a lump sum this tax year.

Ad Is Your Pension Working Hard Enough For You. Get the facts your free guide today. For every 1 of pension you give up you will get 12 of tax free lump sum.

There is a maximum amount that can be taken as a tax free lump sum which is set by HM Revenue and Customs which is 25 per cent of the capital value of your pension benefits or if. Learn the alternatives to your pension plan. Multiply the present value factor by the annual payment.

Retirement Lump Sum Benefits. In the example 124622 times 10000 equals 124622. Tax on lump sums at retirement.

Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds.

Learn the alternatives to your pension plan. Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Its Never Too Early To Start Saving For Retirement.

When you take your pension you will be able to give up some of it for lump sum up to a certain limit. This calculator has been updated for the and 2022-23 2021-22 and 2020-21 tax years. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

Find out what the required annual rate of return required would be for. How is lump sum pension payout calculated. Our Pension Lump Sum Tax Calculator has been designed to help you understand what you may receive from your Phoenix Life Individual Pension Policy if you took all your pension savings as.

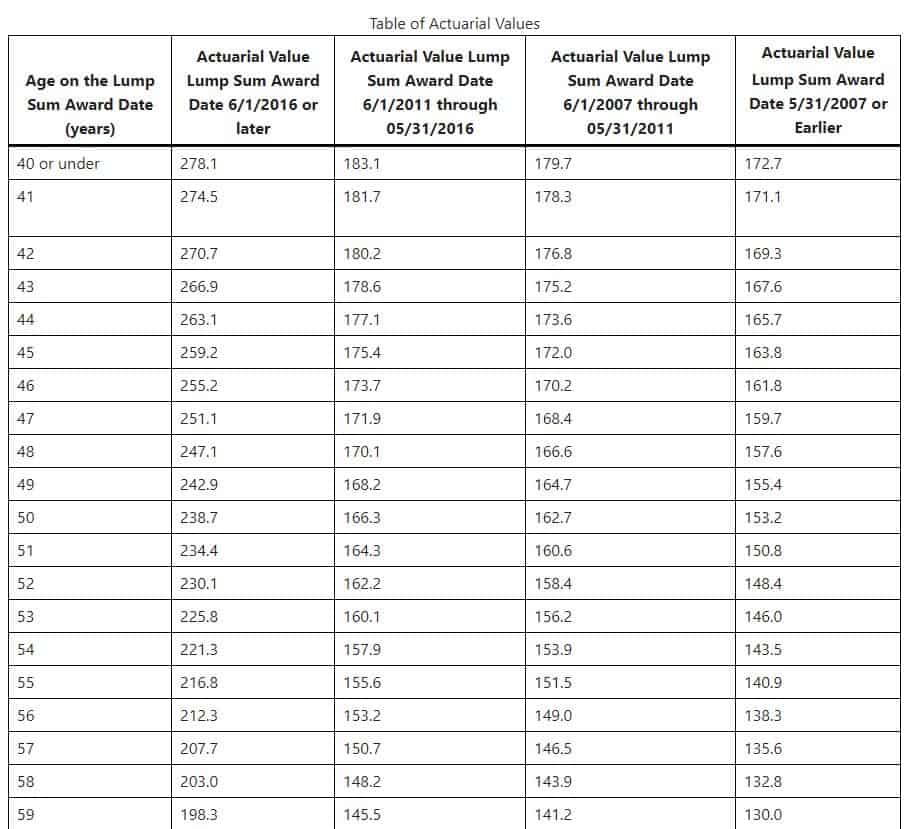

On the day the pension starts their age will be 54 years and 7 completed months. Pension lump sum withdrawal tax calculator. Get the facts your free guide today.

Calculation of tax relief on Eileens retirement lump sum Calculation Value. Find out what the required annual rate of return required would be for. To calculate your percentage take your monthly pension amount and multiply it by 12 then divide that total by the lump sum.

After retiring people who are part of the 1995 Section get a lump sum. We can help find the right umbrella company for your current contract. Therefore if the person took the lump sum he should receive 124622.

Get Started With TIAA Today. In fact up to 25 of the value of your pension can be taken tax-free and our handy calculator will help you to estimate the balance between lump sum and annual pension thats. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Ad Calculate Your Personal Pension And See How Much Income You Could Receive In Retirement. Enter the cash lump sum amount you want to take from your pension pot within the tax year 06 Apr 2022 to 05 Apr 2023. The relevant commutation factor is 221.

This is a total lifetime limit even if lump sums are taken at different times.

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money Your Wealth Podcast 354 Youtube

3 Ways To Calculate Retirement Benefits In Kenya Wikihow

Pension Calculator 2 2 Free Download

Pension Calculator Pensions Calculator Words Data Charts

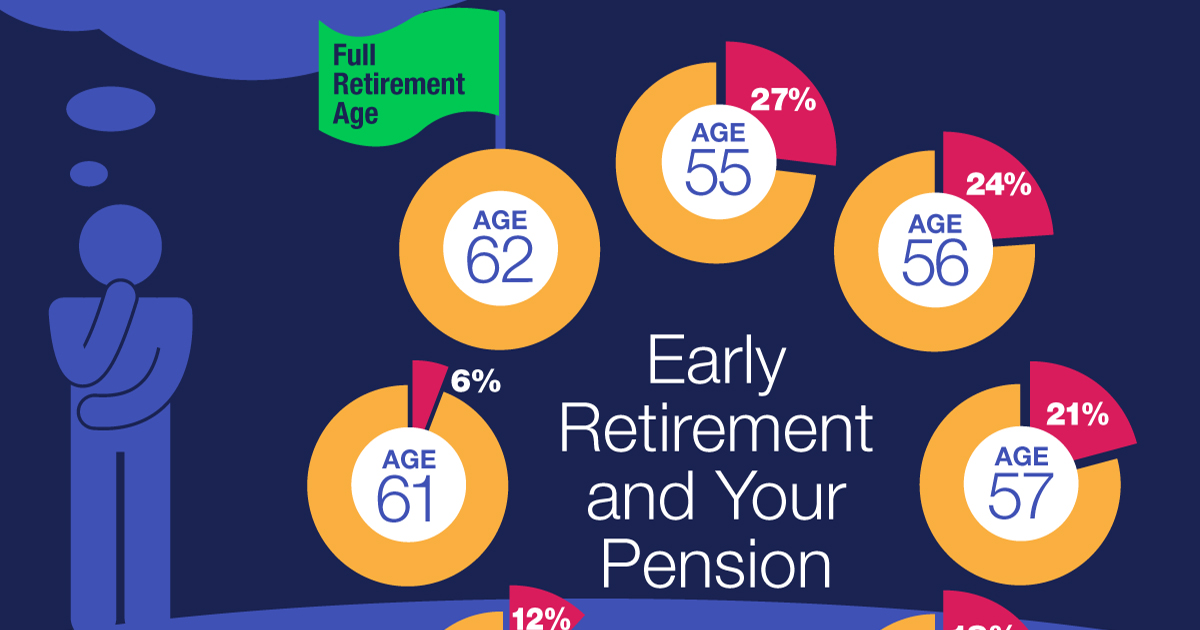

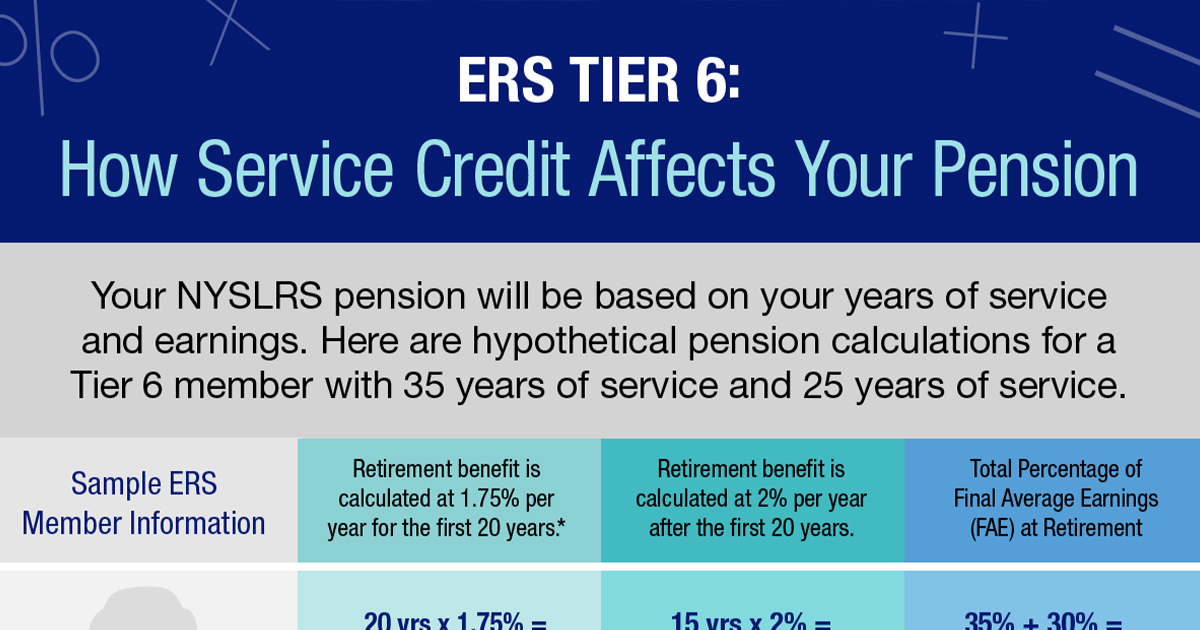

Tier 3 4 Members When Is The Right Time To Retire New York Retirement News

Tax Withholding For Pensions And Social Security Sensible Money

How To Pick Your Retirement Date To Optimize Your Chevron Pension

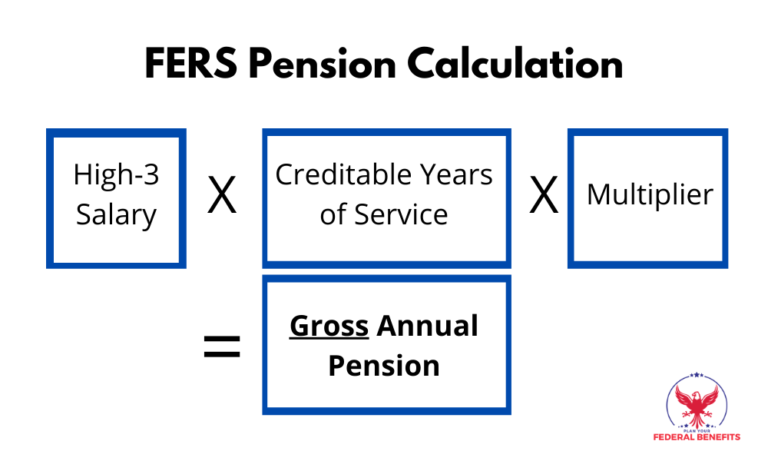

Federal Pension Calculator Government Deal Funding

1

Cagr Calculator For Stocks Index Mutual Funds Fd Calculate In 3 Easy Steps Financial Instrument Mutuals Funds Systematic Investment Plan

Strategies To Maximize Pension Vs Lump Sum Decisions

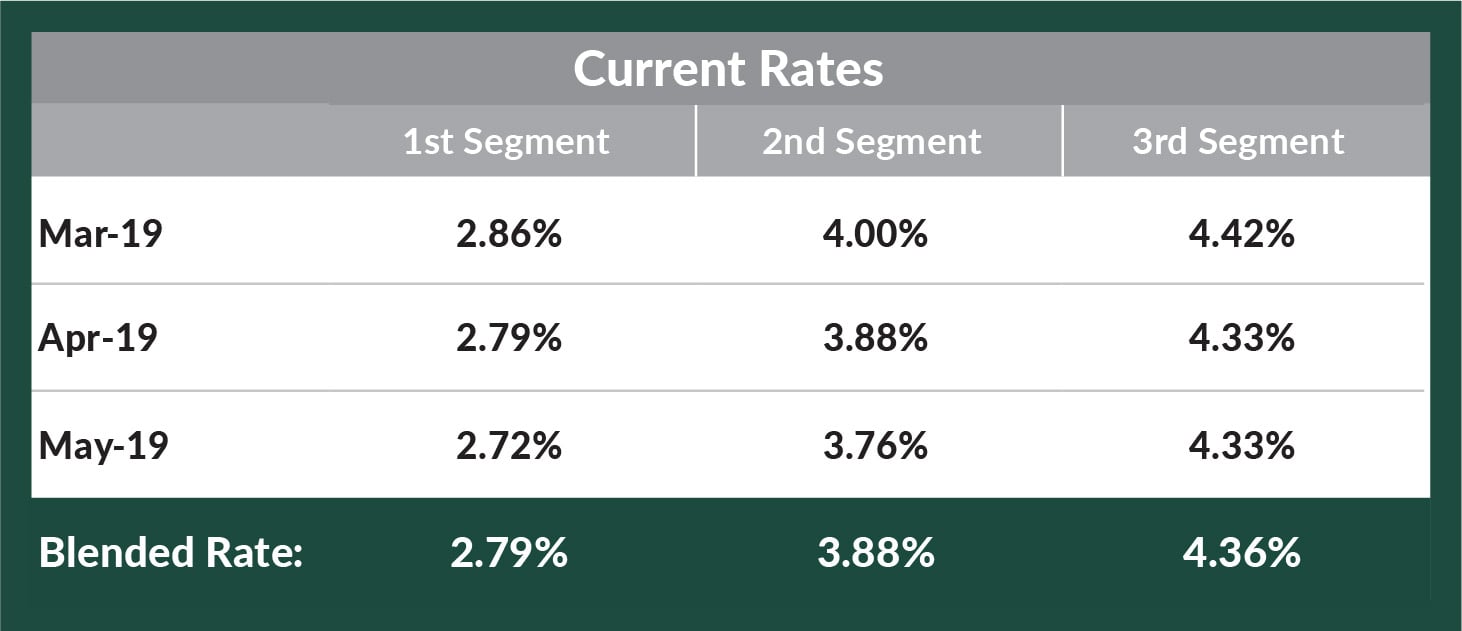

Can I Take My Fers Pension As A Lump Sum Government Deal Funding

Ers Tier 6 Benefits A Closer Look New York Retirement News

1

3

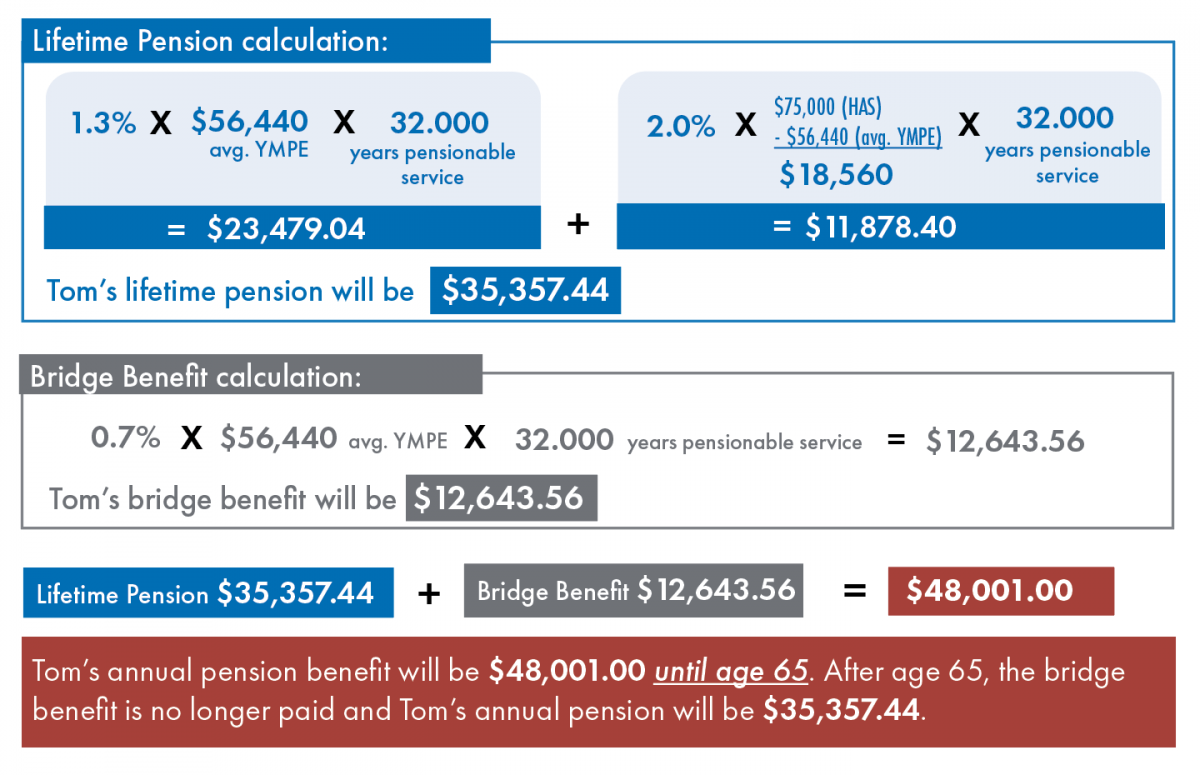

How Your Pension Is Calculated Nova Scotia Teacher S Pension Plan

Social Security And Lump Sum Pensions What Public Servants Should Know Social Security Intelligence